Turning private pensions into a digital investment experience

Client Unimed Seguros

Agency Livework São Paulo

Year 2021

My role I led the discovery and design, collaborating with other designers in the team

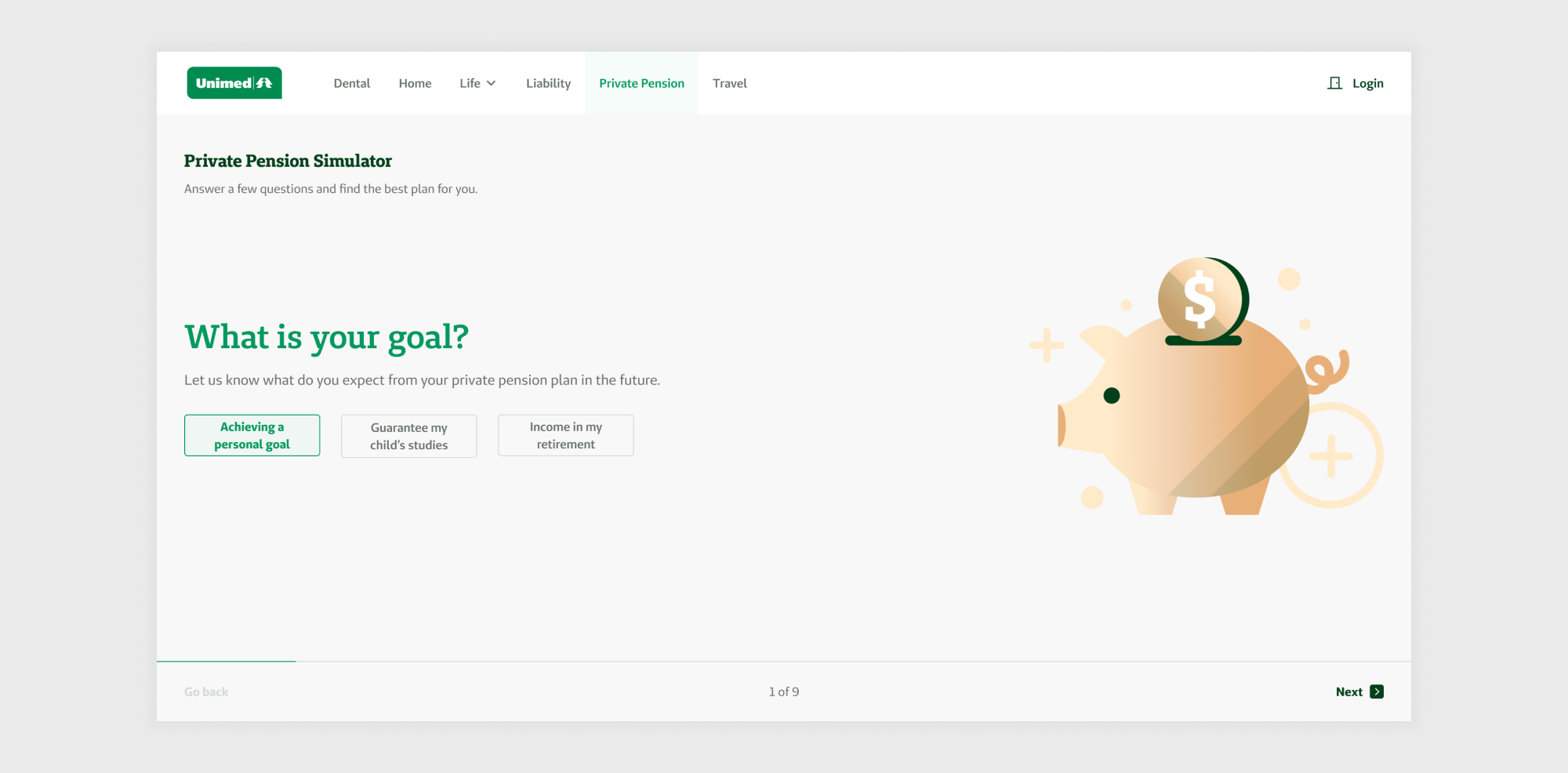

Overview of the landing page.

Overview

To transform Unimed’s private pension plans into a digital-first investment experience, and close the gap with competitors already selling pensions online, I designed an end-to-end purchase journey supported by a tax benefit calculator and a plan simulator that simplified decision-making and positioned pensions as clear, trustworthy investments.

Opportunity

Unimed’s Private Pension team relied on a traditional, broker-led model and was skeptical that such a complex product could be sold online. Brokers were seen as essential, clients rarely made impulsive decisions, and trust in the company was critical.

This skepticism became our design opportunity: to reframe pensions as an investment product that clients could confidently purchase through a clear, trustworthy digital journey.

Discovery phase

In order to have a full understanding of the challenges and opportunities of selling private pensions as a digital investment product, the discovery phase combined technical research, competitor benchmarking, and broker interviews.

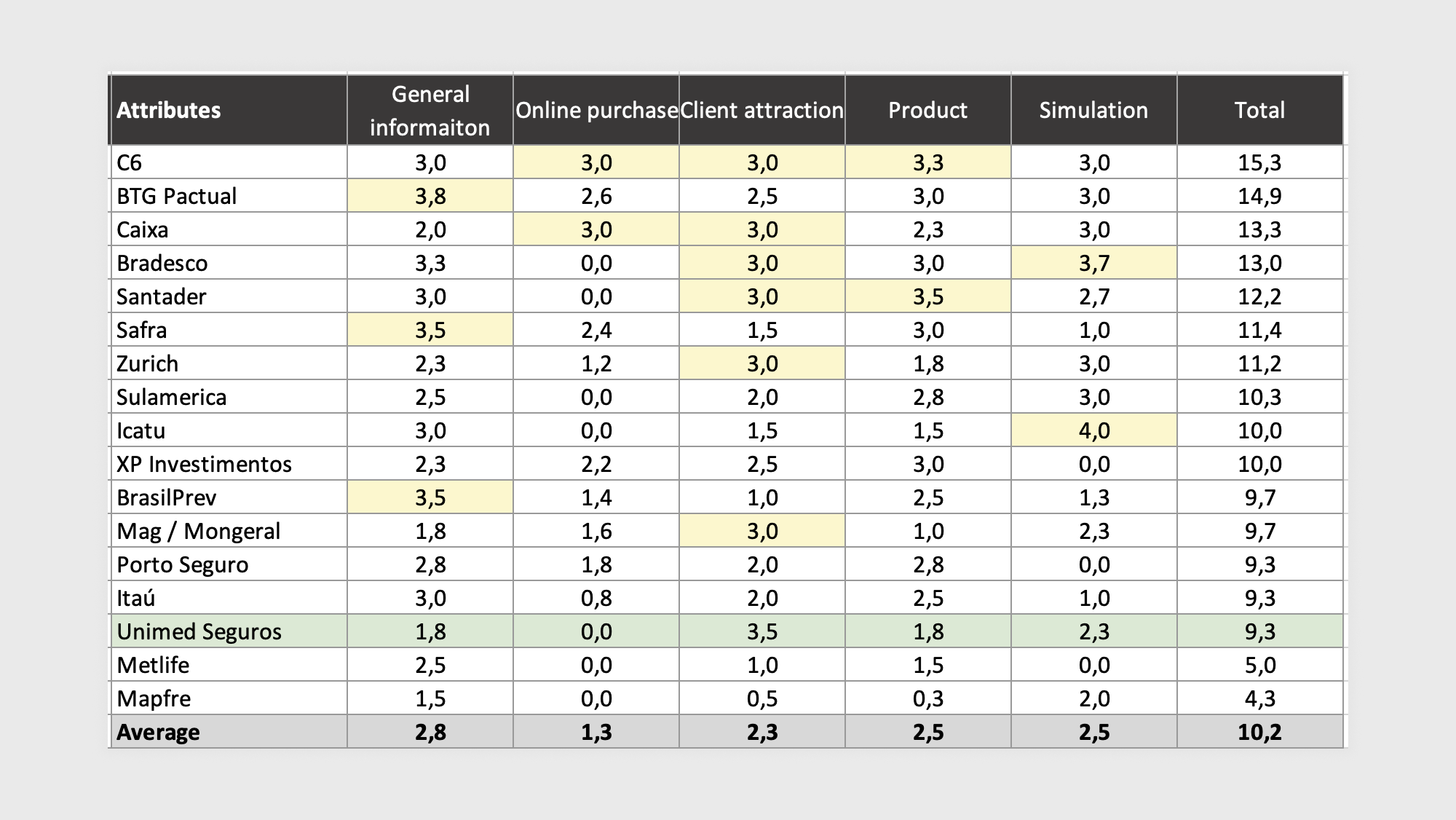

Benchmarking

Objective: Assess the digital maturity of private pension providers in Brazil to identify best practices and innovation opportunities, while creating a quantitative benchmark that revealed Unimed’s gap against competitors and supported internal project approval.

My Approach:

- Analyzed 17 competitors with ≥0.05% market share, using five pillars and 18 attributes to measure digital maturity on a 0–4 scale.

- Averaged team ratings to reduce bias and built a comparative maturity ranking that highlighted Unimed’s gap in the market.

Main Finding: Unimed ranked 15th out of 17 in digital maturity, mainly due to the absence of online pension sales and digital support, while the benchmark revealed that most competitors already offered online purchase, which confirms that digitizing pensions could be a competitive advantage and provided references that guided our design phase.

Table with the results of the digital maturity analysis.

Interviews with brokers

Objective: Understand the sales process, client motivations, and product positioning from the perspective of experienced brokers.

My Approach:

- Conducted 5 interviews with brokers who sold Unimed and competitor products.

- Explored topics such as sales process, purchase motivations, product characteristics, and broker–company relationships.

Outcomes: Identified key pain points and success factors in the traditional sales model, gathering insights that informed the design phase, particularly around trust, complexity, and decision-making in private pension sales.

Examples of findings on broker pain points regarding the sales process of private pensions.

Implementation

Based on the insights from the discovery phase, I set out to design each step in the digital purchase journey.

Landing page

Objective: As the entry point of the purchase journey, the landing page needed to inform, build trust, and motivate users to start investing in a private pension plan with Unimed.

My Approach:

- Drive conversion: Opened with a clear, compelling value proposition and a prominent call to action, inviting users to simulate a plan. To lower the barrier, we highlighted that it was possible to start investing with as little as R$ 100,00.

- Educate with clarity: Structured content around the What, Why, and How of private pensions, addressing misconceptions and simplifying complexity with accessible language.

- Build credibility: Reinforced trust through customer testimonials, company background, and key numbers that our research identified as critical decision-making factors.

Desktop

Mobile

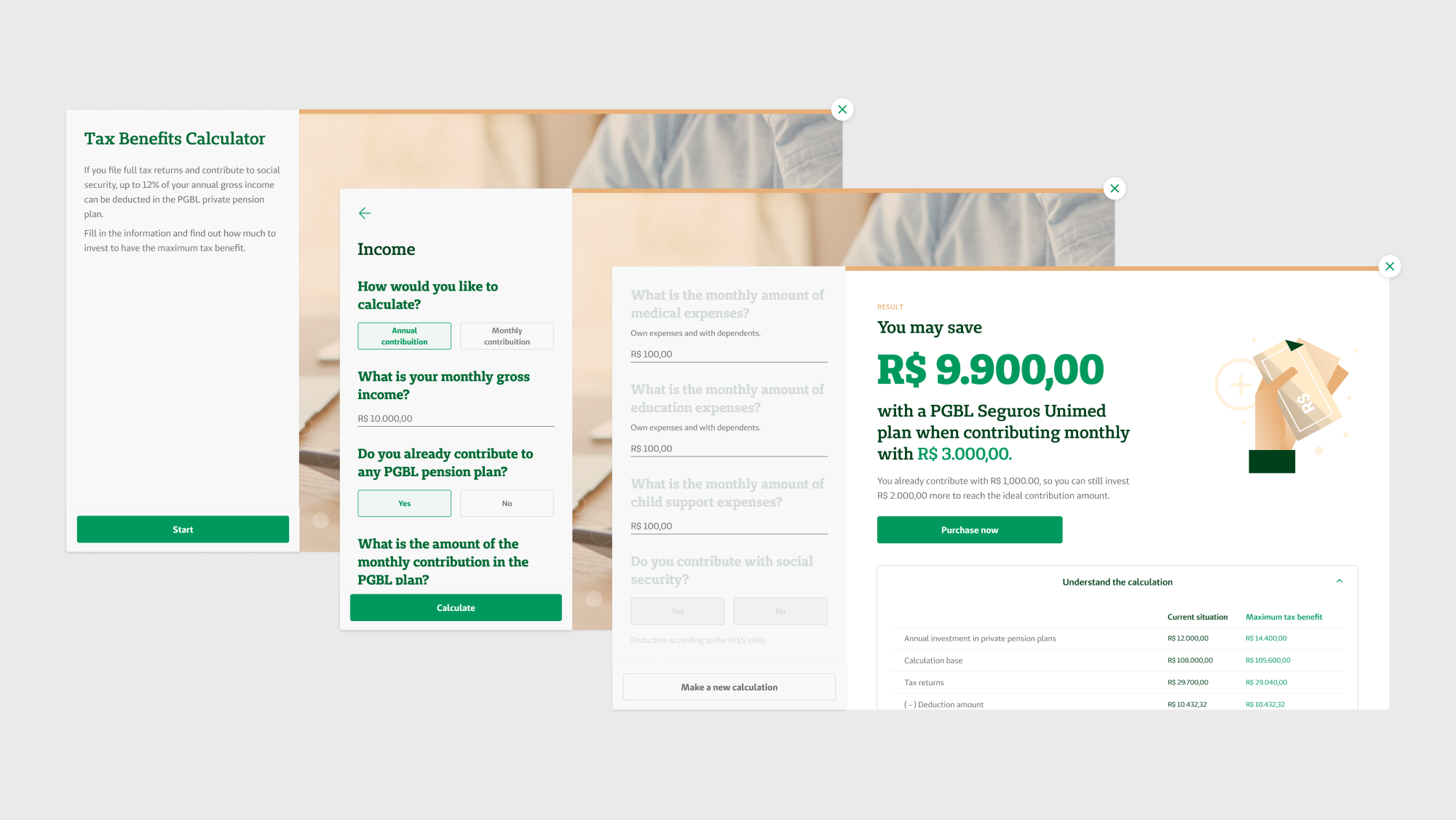

Tax benefit calculator

Objective: Showcase the tax advantages of private pension plans as a compelling trigger for investment, making the product both more attractive and more relevant to each user’s financial reality.

My Approach:

- Interactive and personalized: Created a calculator that allowed users to input their own information and compare different pension modalities, testing multiple scenarios to make confident, informed decisions.

- Streamlined user flow: Minimized friction by limiting the number of questions and using simple, intuitive interactions such as multiple-choice buttons or numeric fields, avoiding dropdowns or complex forms.

Tax benefits calculator - Desktop

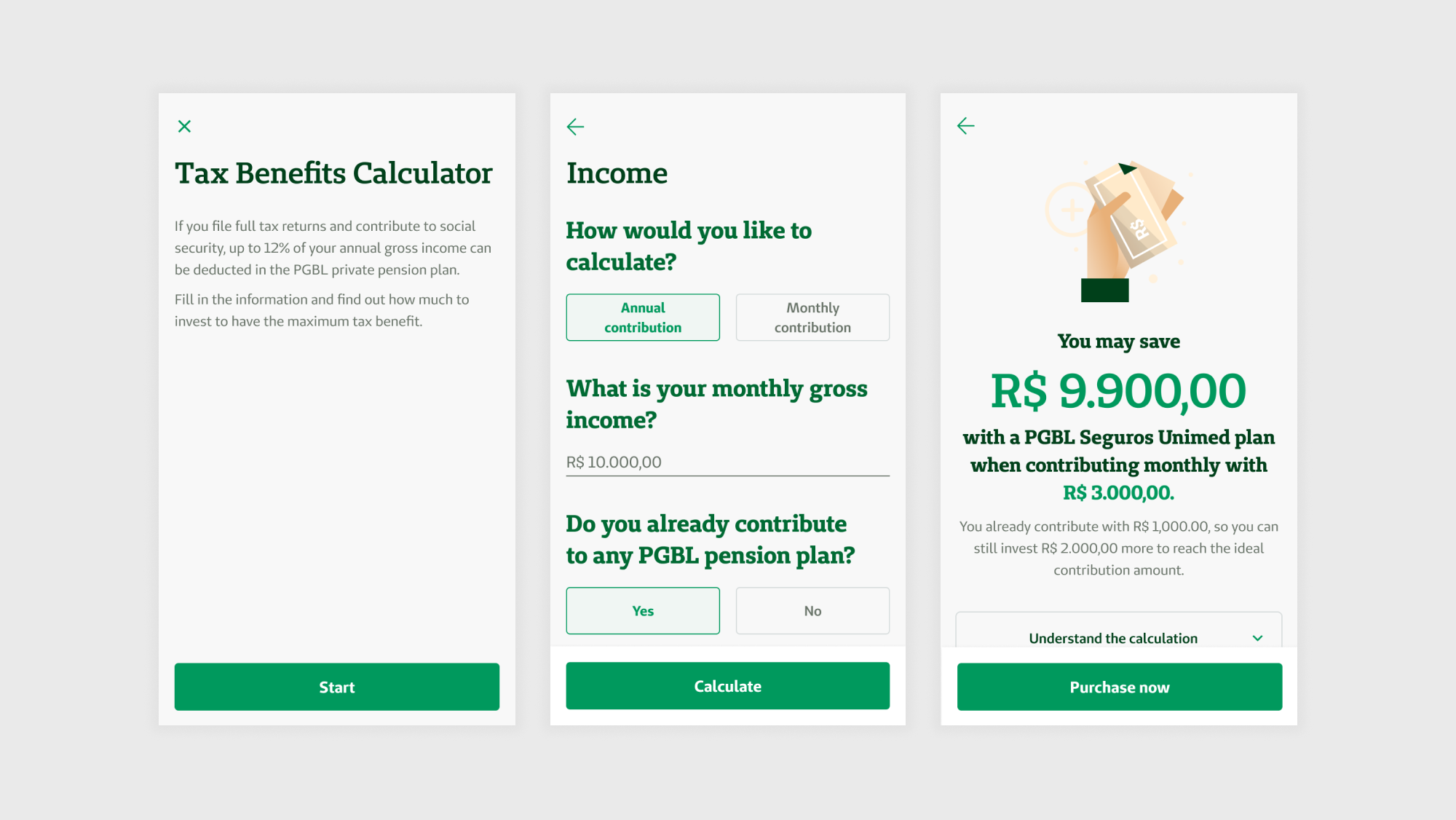

Tax benefits calculator - Mobile

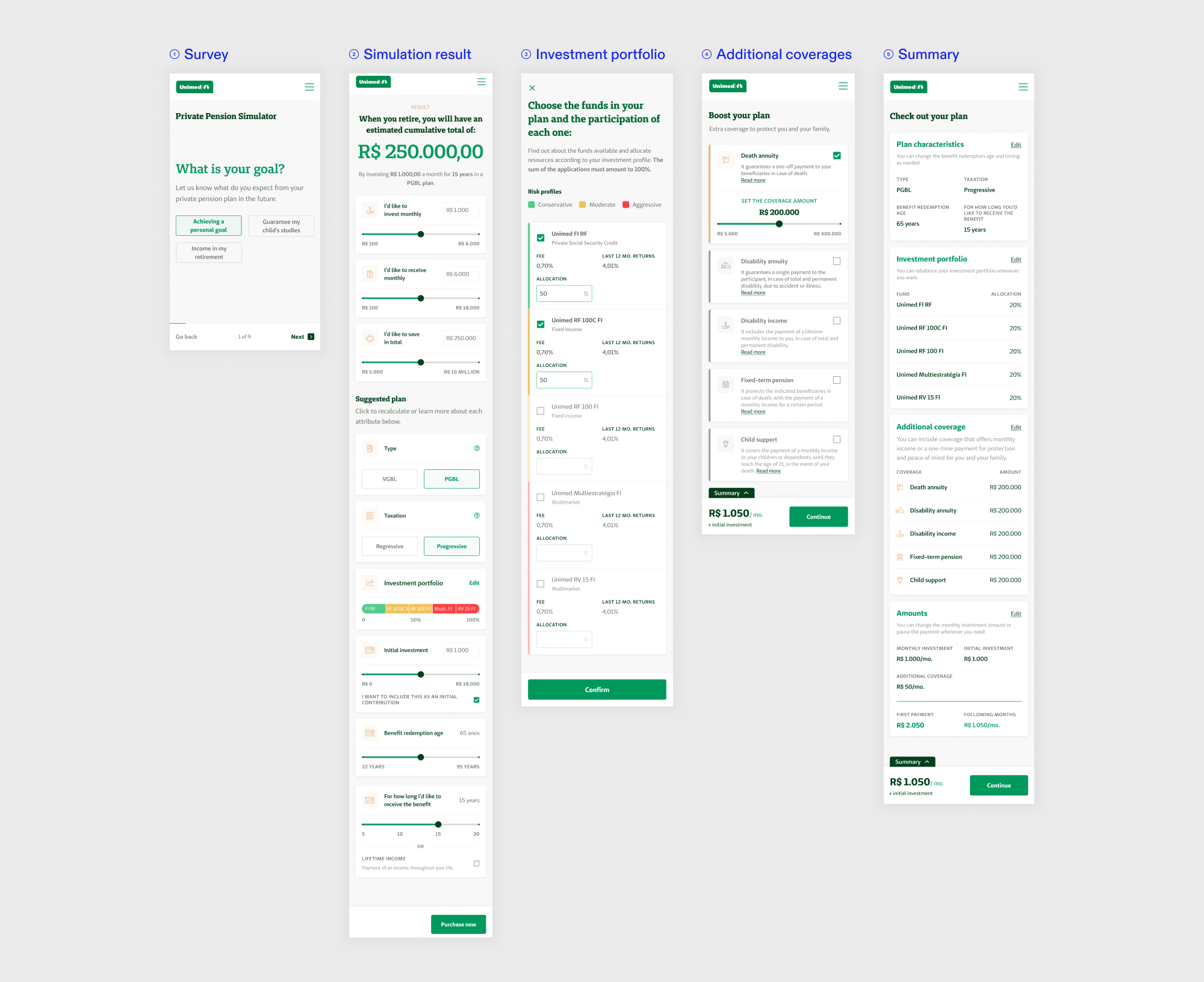

Plan simulator

A simple and intuitive way to set up an investment plan tailored to the needs of the user.

SURVEY

Objective: Collect essential information about the user’s financial goals and current situation in order to recommend the most suitable private pension investment plan.

My Approach:

- Guided and simple: Designed a step-by-step flow that displayed one question at a time, reducing cognitive load and ensuring the user never felt overwhelmed. Options were presented clearly, with open fields only when numbers were required.

- Flexible entry points: Allowed users to simulate in the way that made the most sense to them, whether by setting a monthly or yearly contribution, defining a desired final amount, or choosing how much income they would like to receive upon retirement.

Survey question.

Simulation result, Investment portfolio and Additional coverageS

Objective: Enable users to clearly visualize their simulated plan and personalize it by adjusting contributions, investment funds, and optional coverages to match their financial goals.

My Approach:

- Visual and intuitive: Replaced traditional forms and spreadsheets with charts, sliders, and cards, making the experience more engaging and easier to understand.

- Real-time feedback: Allowed users to adjust plan details dynamically and instantly see updated results, eliminating the need to backtrack or reload pages and ensuring a seamless flow.

Simulation result.

Investment portfolio. (Click to enlarge)

Additional coverages. (Click to enlarge)

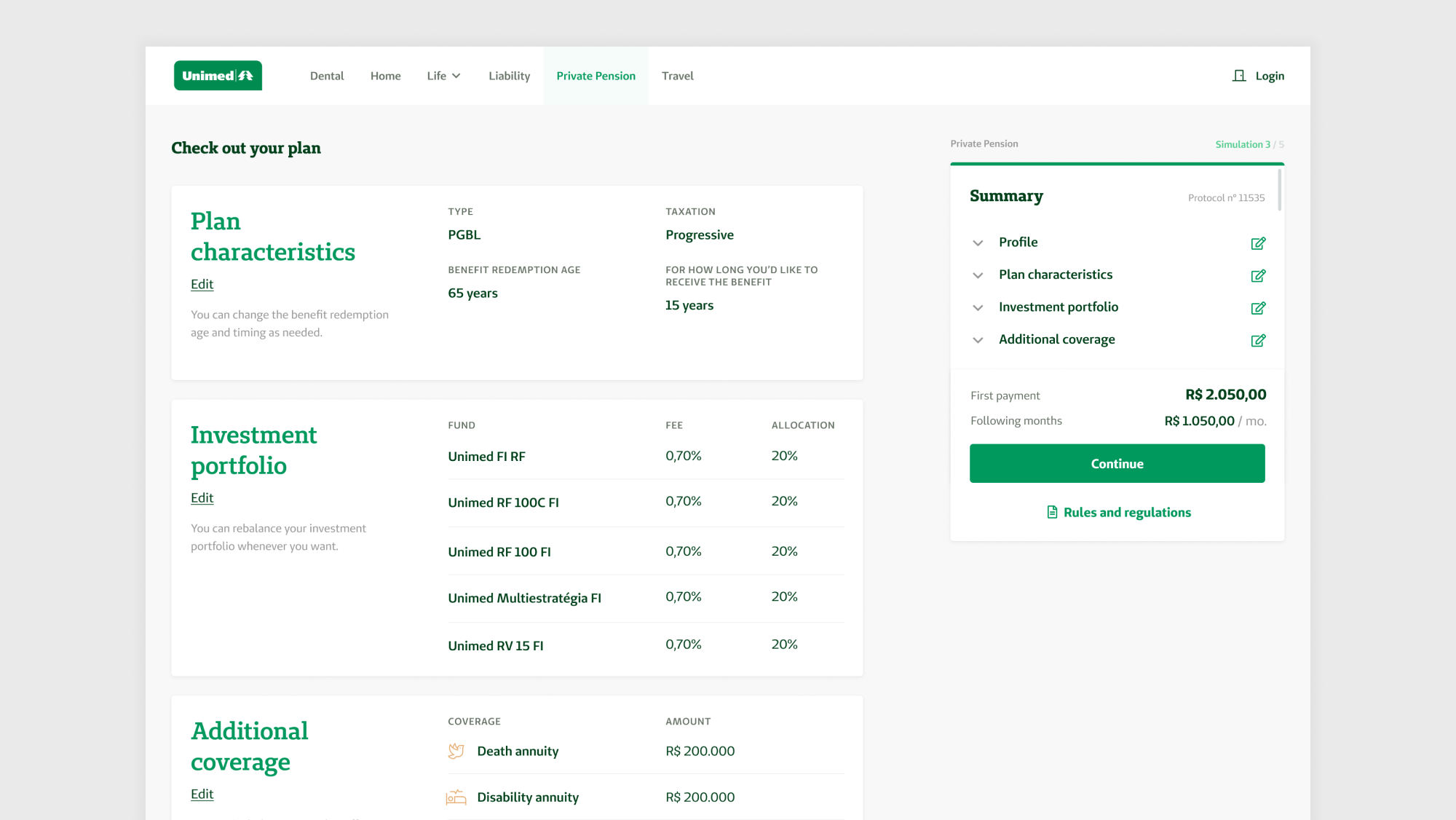

SUMMARY

Objective: Provide a clear, consolidated view of the selected plan so users can confidently review and confirm all details before completing the purchase.

My Approach:

- Clarity and scannability: Designed a structured overview with content grouped by topic, making it easy to scan. Payment details were placed prominently and fixed next to the confirmation button to reinforce transparency and drive action.

- Flexibility until the end: Allowed full customization up to the final step, enabling users to quickly correct mistakes and proceed smoothly to payment, reducing friction and improving conversion.

Summary page.

Impact

One year after launch:

- Private pension plans generated nearly 10% of the website’s total earnings.

- The product page became a major traffic driver, accounting for over 20% of all site visits.

The project successfully reframed private pensions as a digital investment product, proving that an online purchase journey could both build trust and drive business growth, and repositioned Unimed as a competitor in the private pension market.

Plan simulator - Mobile screens.

My takeaways

- Domain expertise matters: Designers must quickly gain deep knowledge of complex products like private pensions, while relying on internal experts to ensure compliance with regulations.

- User validation is crucial: The rush to launch limited research and usability testing, which could have provided richer insights from real clients.

- Design drives change: This project showed how design can shift organizational mindset while delivering measurable business impact.